American’s infrastructure has been failing for quite some time.

One look at the countless potholes, congested roads, derailed trains, collapsed bridges and dams is proof enough. Just to fix it all could cost as much as $3.6 trillion by 2020, says the American Society of Civil Engineers (ASCE).

What’s worse, the ASCE just gave current U.S infrastructure a D+ rating. Even the Federal Transit Administration (FTA) has estimated that there’s an $808.2 billion backlog in deferred maintenance on the nation’s rail and bus lines.

On top of that, according to the American Road and Transportation Association, nearly 56,000 bridges in the U.S. alone are structurally deficient. More than 25% of current bridges are more than 50 years old, as well.

Yet, federal spending on infrastructure has fallen 9% in the last 10 years.

Worse, we need to fix just about everything, even the water supply.

Consider this, for example.

The U.S. needs $1.27 trillion over the next two decades to meet the growing demands for wastewater and safe drinking water. At the moment, the U.S. alone consumes 42 billion gallons of treated drinking water every day. Yet, six billion gallons are lost because of leaking pipes.

On top of that, a lack of progress in infrastructure repairs could cost U.S. GDP $3.9 trillion by 2025. Businesses could lose $7 trillion by 2025. More than 2.5 million jobs could be lost. All thanks to poor roads and airports, an aging electrical grid, and higher costs for businesses, which are passed to families and workers.

Tack on lost productivity, poor public health issues, car damage, delays to the issues, and experts say to fix it all could cost us trillions more by 2020, according to the American Society of Civil Engineers (ASCE).

Some issues are so severe, it’ll cost billions just to bring it all to safe standards.

Enter the Biden Administration

Adter passing the $1.9 Trillion Covid Relief Bill, one of the next priorities is the “Build Back Better” Bill, which would earmark $3 Trillion not only to fix roads and bridges, but to address other needs including:

– 5G rollout

– Nationwide broadband internet access

– Green electrical grid

– Semiconductor production

– Carbon-free transportation

Make no mistake about it; actual infrastucture projects on a large scale will be a priority.

Some of the top infrastructure leaders could be:

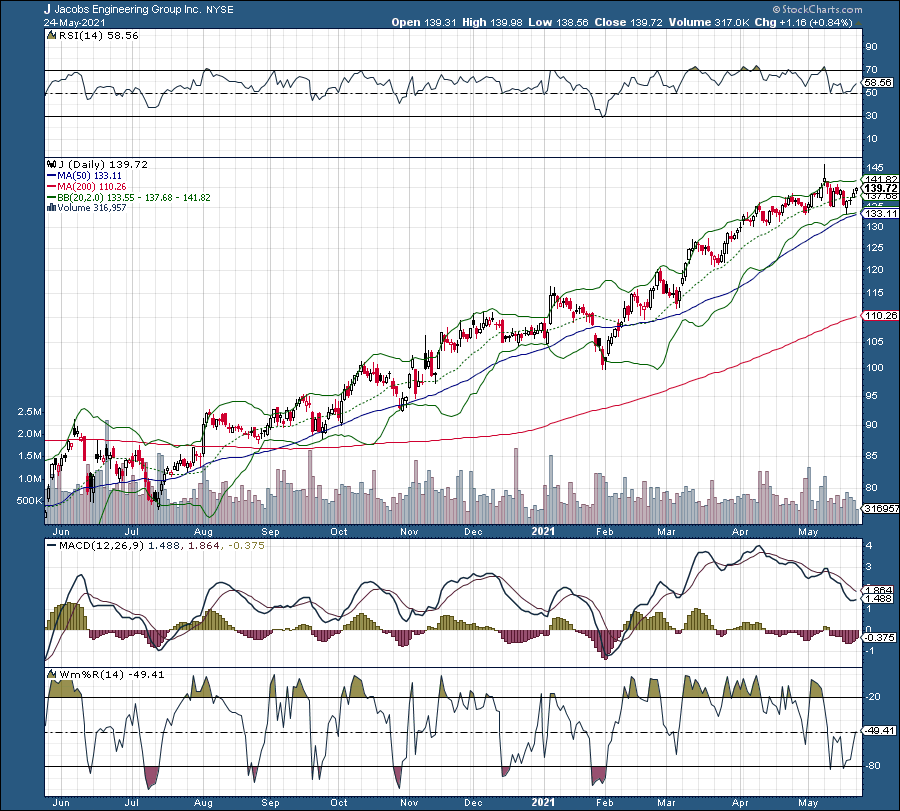

No. 1 – Jacobs Engineering (J)

Since the Covid crash of March 2020, shares of Jacobs Engineering soared from a low of $60 to $123, for example. This is the company that provides technical, professional, and construction services. It offers project services that include engineering, architectural, interiors, design, planning, and related services, as well as planning, scheduling, procurement, estimating, cost engineering, project accounting and delivery, safety, and other support services.

[PDF] Options Trading Strategies Guide

This FREE strategy guide breaks down 11 specific options methods for a total game plan in any market condition!

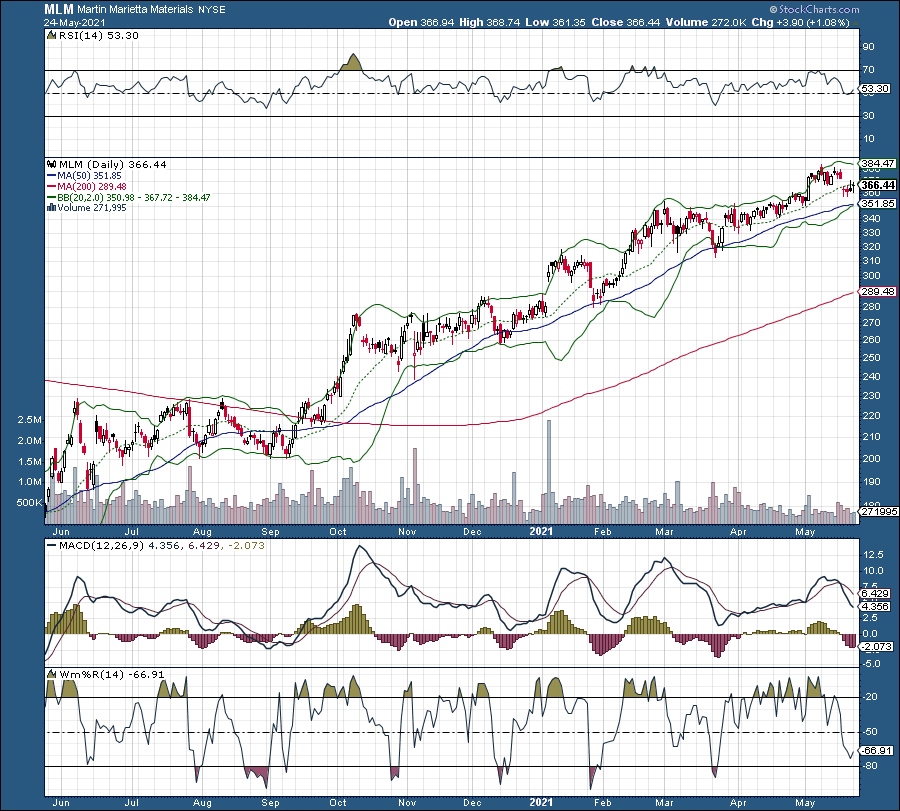

No. 2 – Martin Marietta Materials (MLM)

When it comes to infrastructure, you need gravel, sand, crushed stone, asphalt and cement, which is where MLM comes into play. This is one of the top ones for investors, who have watched as net sales grew from $1.6 billion in 2010 to $3.6 billion just six years later. Earnings per diluted share even popped from $2.10 to $6.63 by 2016. Its projects can be seen all over the country and there’s no question each would see a lot of increased business in the event of a new infrastructure plan from the Administration.

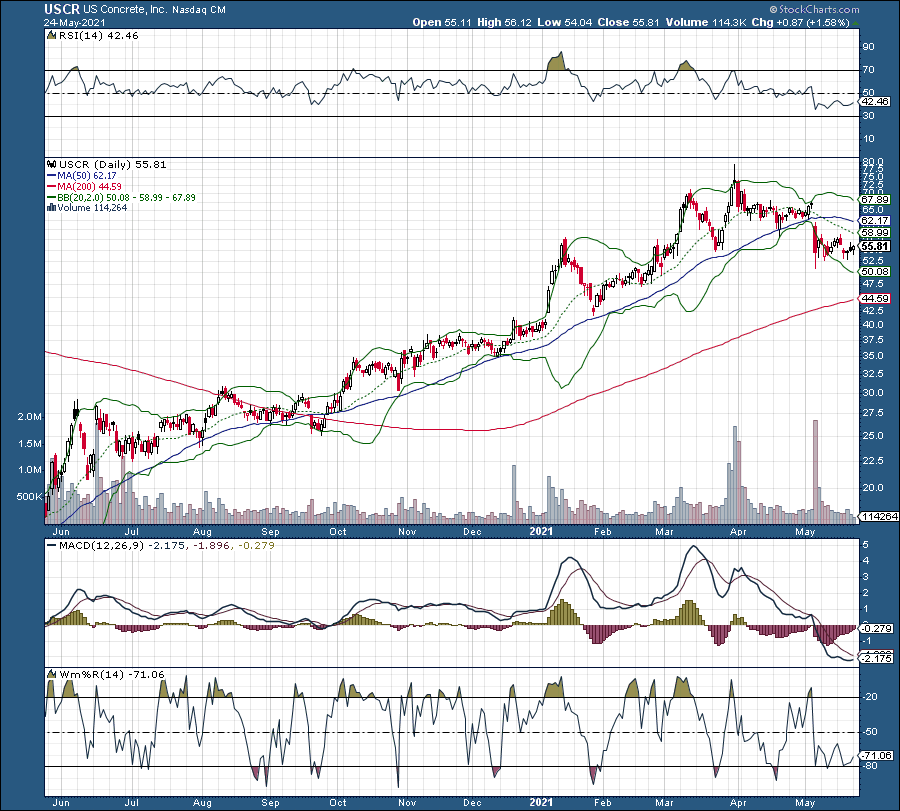

No. 3 – U.S. Concrete (USCR)

The company produces and sells ready-mixed concrete, aggregates, and concrete-related products and services for the construction industry in the United States. It operates through two segments, Ready-Mixed Concrete and Aggregate Products. The Ready-Mixed Concrete segment engages in the formulation, preparation, and delivery of ready-mixed concrete to customers’ job sites; and the provision of various services that include the formulation of mixtures for specific design uses, on-site and lab-based product quality control, and customized delivery programs.

The Aggregate Products segment offers crushed stone, sand, and gravel for use in commercial, industrial, and public works projects. The company also engages in the operation of building materials stores; provision of concrete blocks, lime slurry, and Aridus rapid-drying concrete technology; sale of brokered products; hauling and recycled aggregates operation activities; and operation of aggregates distribution terminals, as well as transfer trucks for transporting cement and aggregates. It primarily serves concrete sub-contractors, general contractors, governmental agencies, property owners and developers, architects, engineers, and homebuilders.