The Dogs of the Dow is a stock-picking strategy that involves investing in the 10 highest-yielding Dow Jones Industrial Average (DJIA) stocks. The theory behind this strategy is that these high-yielding stocks are undervalued and therefore likely to provide strong returns over the long term. The DJIA is a stock market index that consists of 30 large, publicly traded companies that are representative of a variety of industries. The 10 highest-yielding stocks in the DJIA are often referred to as the “Dogs of the Dow.”

To implement this strategy, an investor would buy equal dollar amounts of the 10 highest yielding DJIA stocks at the beginning of the year and hold onto them for the entire year. At the end of the year, the portfolio would be rebalanced by selling the stocks that are no longer among the highest-yielding and replacing them with the current top-yielding stocks. This process is then repeated each year.

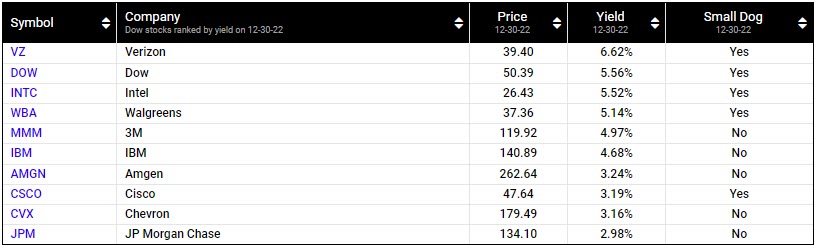

2023 Dogs of the Dow

Source: DogsoftheDow.com

How Does the Dogs of the Dow Strategy Compare Against the Overall Markets?

To see how the Dogs of the Dow Strategy compares to overall market performance, let’s first look at DIA, an ETF which tracks the performance of the Dow Jones Industrial Average.

In 2022, DIA opened at $365 and ended the year at $331, down 10% in a year where markets were hammered by war in Ukraine, high inflation, supply chain issues, rising interest rates and ongoing pandemic uncertainty.

Now let’s look at SDOG, an ETF which tracks the Dogs of the Dow.

As you can see, the two charts look almost identical.

The difference is that the Dogs of the Dow focuses on the most beaten-up, highest yielding components of the Dow. The idea is that these stocks belong to solid companies that have a large upside.

Like Verizon (VZ)

Verizon rang in 2022 trading at $54 and drifted all the way down to $39, down 18%, while paying a dividend yield of 6.62%. If you believe that Verizon isn’t going anywhere, then a purchase of 100 shares would appreciate from $3,900 to $5,400 if price comes back to equal where it was at the start of 2022.

Instead of picking individual components in the Dogs of the Dow, you could also buy 100 shares of SDOG, which buys you the entire Dogs of the Dow sector.

It’s important to note that the Dogs of the Dow strategy is not without its risks, and it may not outperform the broader market in all market environments. As with any investment strategy, it’s important to carefully consider your own financial goals, risk tolerance, and investment horizon before deciding whether the Dogs of the Dow strategy is right for you.